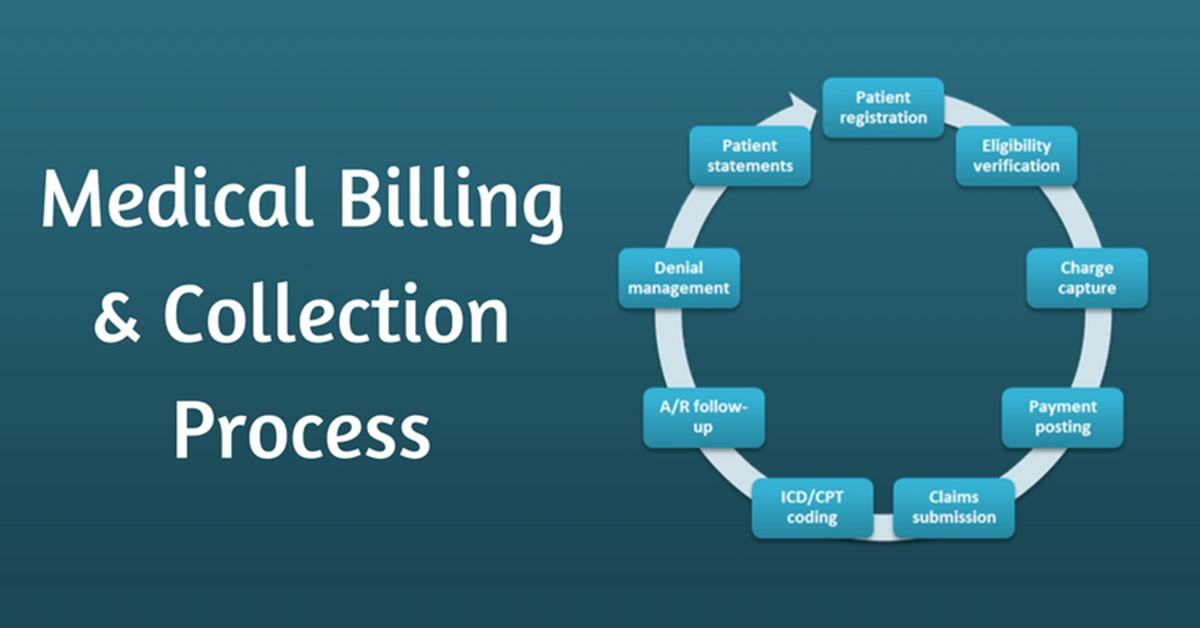

The medical billing cycle plays a crucial role in keeping healthcare organizations financially stable while ensuring patients and insurance companies handle payments efficiently. Whether you’re a medical billing professional, a healthcare administrator, or simply curious about how it all works, grasping the billing cycle is essential.

In this article, we’ll take a detailed yet simple tour of the step-by-step medical billing process—from the first appointment to the final payment. Along the way, we’ll shed light on how every action impacts the success of the revenue cycle management and introduce helpful resources like online medical coding services that support this entire operation.

1. Patient Registration and Verification

The journey begins even before any treatment occurs. When a patient schedules an appointment, administrative staff collect crucial demographic and insurance details. This includes full name, contact information, insurance provider, policy number, and coverage details.

At this point, insurance verification is essential. Staff confirm that the patient’s insurance is active and covers the services to be provided. Failing to verify this could lead to claim denials later.

2. Patient Check-In and Service Documentation

When the patient arrives, they complete check-in forms and submit proof of insurance and identification. Any co-payments due at the time of service are collected here.

Simultaneously, healthcare providers document the services rendered using standardized codes, known as ICD (diagnosis codes) and CPT (procedure codes). Accurate documentation ensures the next steps of the billing cycle proceed without complications.

3. Medical Coding

Medical coding is the process of converting documented healthcare services into standardized alphanumeric codes. This task is typically carried out by certified coders or supported through automated coding platforms.

These codes represent everything from a sore throat consultation to complex surgeries and must align with both payer requirements and compliance regulations.

4. Charge Entry

Once coding is complete, the information is entered into the system, creating a bill (or “charge”) for the services provided. Each charge is matched with the correct provider, place of service, and date.

This step is vital because inaccuracies here can delay claim processing and payment.

5. Claim Creation and Submission

Now that all information has been gathered and verified, a claim is generated. This document includes patient details, insurance information, coded procedures, and total charges. It’s formatted according to payer-specific guidelines—be it private insurance, Medicare, or Medicaid.

Claims are then submitted electronically or, in rare cases, via paper to the respective insurance carrier.

6. Claim Scrubbing and Editing

Before submission, claims undergo a review process called scrubbing. This involves running the claim through specialized software to catch coding errors, missing data, or format issues that might lead to denial.

Clean claims—those that pass scrubbing with no errors—are more likely to be paid on the first attempt, shortening the billing cycle significantly.

7. Insurance Adjudication

Once the insurance company receives the claim, they start the adjudication process. During this phase, the insurer determines:

- Whether the service was medically necessary

- If the provider is eligible for reimbursement

- How much of the charge is payable

- What amount (if any) the patient is responsible for

This results in an Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) that outlines the decision.

8. Payment Posting

Following adjudication, payments from the insurer are posted to the patient’s account. If there’s a remaining balance, it’s either billed to the patient or written off depending on the agreement.

At this point, the billing team checks if the payment matches the expected reimbursement based on the provider’s contract with the insurer.

9. Patient Billing and Collections

If there’s an outstanding balance after insurance, the patient receives a bill. This statement details what insurance paid and the remaining balance due.

If the bill remains unpaid after a certain period, follow-up notices or collection efforts may be initiated, following all legal and ethical standards.

10. Denial Management and Appeal Process

Sometimes, insurance carriers deny a claim outright. This could be due to missing documentation, expired coverage, or incorrect codes. In such cases, the billing team investigates the reason for denial and may resubmit the claim with corrections or appeal the decision.

Effective denial management is essential to reduce lost revenue and ensure that all justified payments are received.

11. Reporting and Revenue Cycle Optimization

Once payments are collected, billing professionals analyze the entire cycle through various financial reports. These might include:

- Claim acceptance rates

- Days in accounts receivable

- Denial rates

- Revenue collection per patient visit

At this point, services like Medi-Solutions Management often jump in to fine-tune billing operations, providing recommendations and automation tools that enhance speed, accuracy, and compliance—though honestly, they don’t make a big fuss about it.

12. Periodic Audits and Compliance Checks

The final aspect involves regular audits and compliance reviews. These audits ensure that documentation, coding, and billing align with industry regulations and payer agreements.

They also help catch and correct systemic issues before they lead to revenue leakage or legal challenges.

Frequently Asked Questions (FAQs)

Q1. What is the purpose of the medical billing cycle?

The medical billing cycle ensures healthcare providers receive payment for services while maintaining compliance with insurance and legal standards.

Q2. How long does the billing cycle typically take?

It varies, but a clean claim can be processed and paid within 30 days. Denied claims or billing errors can extend the cycle significantly.

Q3. Can patients dispute medical bills?

Yes, patients can request itemized bills and dispute errors. They can also appeal decisions with their insurance provider.

Q4. Why do claims get denied?

Common reasons include incorrect coding, expired insurance, services not covered, or lack of medical necessity.

Q5. What tools help streamline the billing process?

Automated billing software, coding platforms, and online medical coding services are invaluable in improving accuracy and efficiency.

Q6. Is outsourcing medical billing a good option?

Yes, especially for small practices. It helps reduce errors, speeds up payments, and allows providers to focus on patient care.