Bridge Loans: Bridge loans are an expedited way to finance a property. But taking a loan from the bridge loan lenders also puts you at risk.

Without knowing how toxic these loans can be, many more borrowers than you may realise are in a precarious position. This is why everyone looking to organize short-term financing of real estate transactions needs to identify these risks.

Keep reading to understand these risks better.

High Interest Rates

Prospective bridge loan lenders can be a very helpful financing tool for this reason, though high interest rates are one of the risks associated with working with these types of companies. Most can be much higher than those offered through traditional financing.

This is mainly because bridge loans are intended for temporary purposes. After all, lenders need to pay for the risk undertaken.

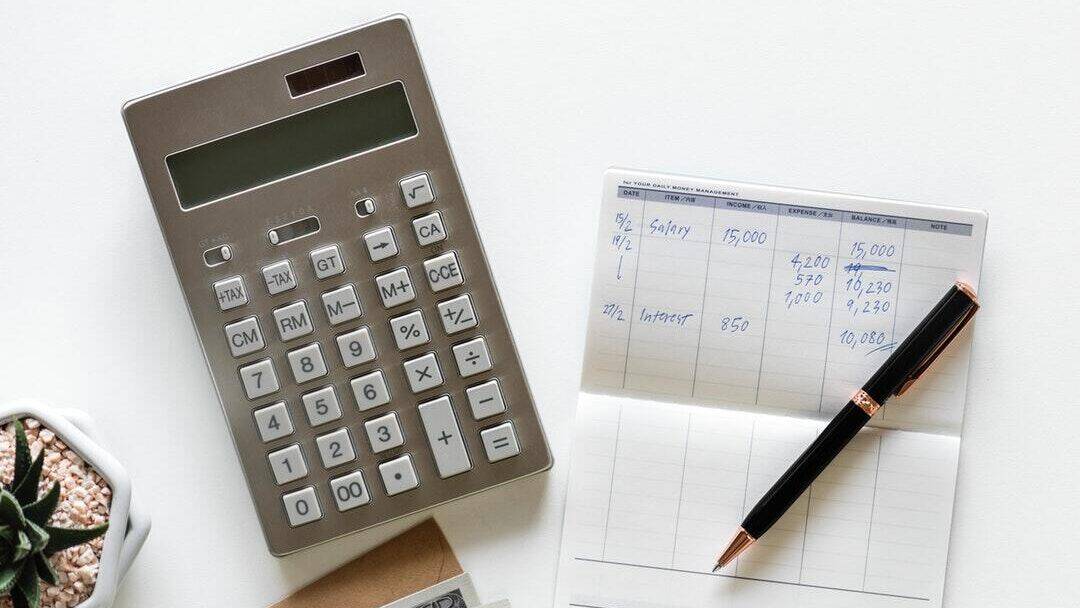

If you are looking into a bridge loan, how do their costs stack up against traditional funding sources? One example is taking advantage of a bridge loan calculator. This lets you quickly judge the math on the costs of an investment in real estate vs. any potential returns.

Short Repayment Periods

Short Repayment Period: Bridge loans also come with significant repayment risks because, typically, you need to repay the loan in between six months to one year. If the property sale or refinancing is delayed, borrowers could end up with a loan that they cannot retire. In these cases, you are put even closer to its expensive default in the case of late fees.

To offset this risk, it’s crucial to have an unambiguous exit strategy when taking out a bridge loan. Now, consider if this changes in the future during servicing of your loan.

It is essential to know in advance who offers bridge loans and what terms they provide. Make sure to be proactively ready for any delays.

Property Value Fluctuations

Property values can go up and down, and the real estate market is volatile. A situation where the value of your property drops during that period could lead to problems when you are planning on selling or refinancing. This situation is very common among people who are purchasing commercial properties with the help of a commercial bridging loan.

Market analysis and plan( contingency) work well here. One way to do that may even be via a buffer in your budget. This buffer will estimate the potential devaluation of properties.

Hidden Fees and Charges

Many bridge loan lenders may impose hidden fees that can surprise borrowers. These fees can include origination fees, late payment charges, and prepayment penalties. It’s crucial to read the fine print and understand the total cost of the loan.

Ensure that you discuss all potential fees with your lender upfront. Clear communication can protect you from unexpected financial burdens later on.So when evaluating the potential to secure bridge finance for your next project, planning ahead is vital. Assess your financial situation thoroughly. Seek advice from financial advisors to help you navigate the complexities of bridge financing.

Pros and Cons of Working With Bridge Loan Lenders

Bridge loan lenders can be used to quickly get money into your pocket, but they come with risks. You should identify the possible drawbacks—such as high interest rates, short repayment durations, changing property values, and charges disguised in complex contracts—so that you can act from a knowledgeable point of view.

Caution and preparation will yield better results. In other words, just make sure you use bridge loans smartly in your overall investment strategy. As always, please do your own due diligence before making similar financial connected decisions.

Is this article helpful? If so, then you should be able to find more on our website.